Ghanaians will soon enjoy a reduction in the cost of goods and services as the government officially scraps the COVID-19 Health Recovery Levy. This is a move many citizens have long anticipated. The repeal takes effect in January 2026, marking the end of the extra 1% charge that has applied to goods, services, and imports since 2021.

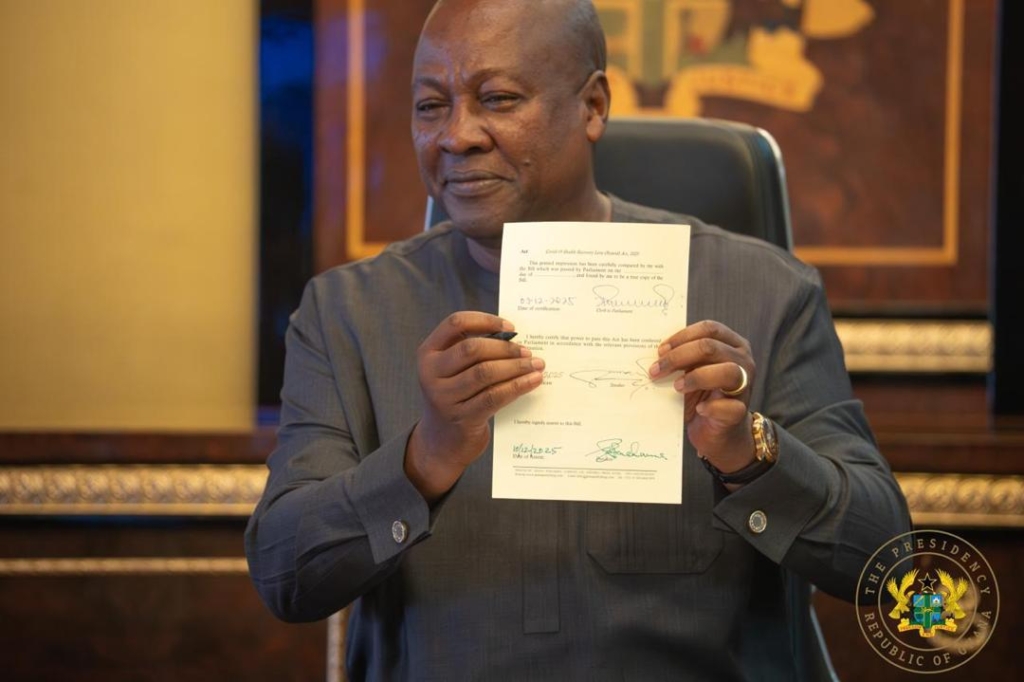

President Mahama signed on Wednesday 11th December, 2025. The government says, this removal of the levy forms part of its broader effort to eliminate nuisance taxes and ease pressure on households and businesses.

For years, consumers have paid this additional cost on top of VAT, NHIL, and other existing levies. Some citizens say, the application of this tax on goods even after the pandemic has long subsided is unfair.

The COVID-19 Levy

The COVID-19 Health Recovery Levy was introduced under Act 1068 in March 2021 as part of Ghana’s pandemic response strategy. It was intended to support healthcare recovery efforts and help rebuild government finances at a time of high COVID-related expenditure.

Though initially described as temporary, the levy remained in place years after. This begun to draw criticism from the public and businesses who said it was outdated and burdensome.

Removal of the COVID-19 (Nuisance Tax); What it Means for Consumers and Businesses in Ghana

According to experts, the scrapping of the levy is expected to provide modest but meaningful relief in the following areas:

- Reduced prices of taxable goods and services

- Lower operational costs for businesses, especially in retail and services

- Smoother market activity due to reduced cost-push inflation

- Improved consumer confidence heading into the 2026 fiscal year

With the repeal now confirmed, the Ministry of Finance will issue detailed implementation guidelines before the January rollout.

For many Ghanaians, the removal of this tax marks a positive shift toward easing the cost of living and reshaping the tax environment to support economic recovery.