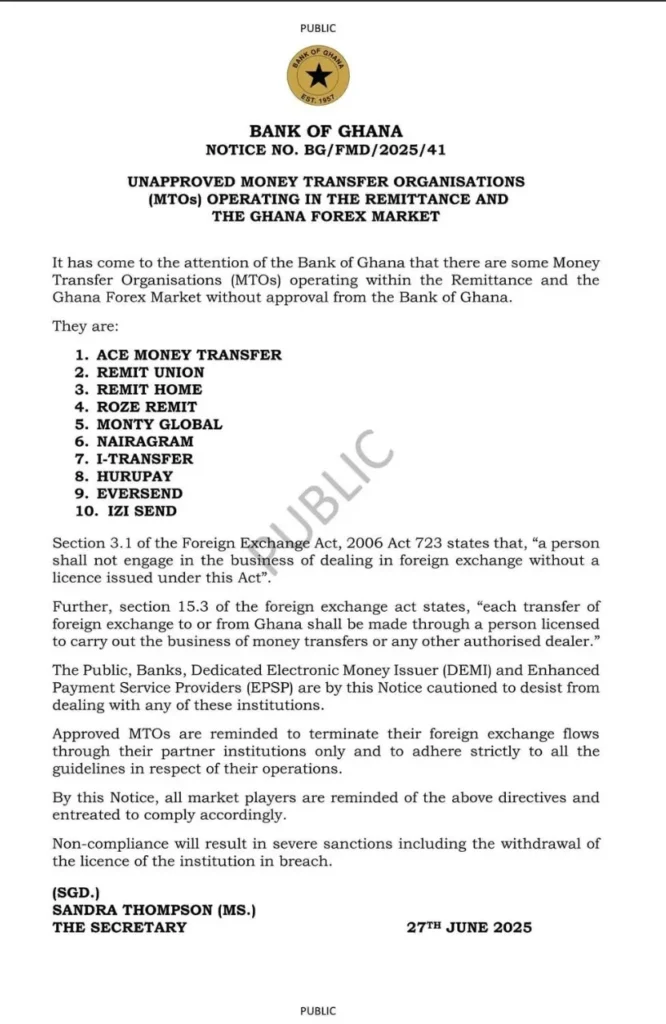

The Bank of Ghana (BoG) has issued a strong warning to the public and financial institutions to stop doing business with ten money transfer companies operating in the country without proper authorisation.

In an official statement released on Friday, June 27, the central bank said the named Money Transfer Organisations (MTOs) are offering services in Ghana’s foreign exchange and remittance market without approval, in breach of the Foreign Exchange Act, 2006 (Act 723).

The affected companies are:

- ACE Money Transfer

- Remit Union

- Remit Home

- Roze Remit

- Monty Global

- Nairagram

- I-Transfer

- Hurupay

- Eversend

- IZI Send

Under the law, only licensed entities are allowed to conduct foreign exchange transfers in or out of the country.

“Each transfer of foreign exchange must be made through a licensed person or an authorised dealer,” the BoG reminded the public, citing the Act.

The bank has also directed banks, Dedicated Electronic Money Issuers (DEMI), and Enhanced Payment Service Providers (EPSP) to cease all dealings with these companies. It warned that failure to comply would lead to sanctions, including the possible withdrawal of licences.

The BoG advised that approved MTOs must route their transactions through licensed local partners and follow all regulatory guidelines.

This move forms part of the Bank of Ghana’s ongoing efforts to clean up the financial space and protect consumers from unregulated service providers.

The notice was signed by Sandra Thompson, Secretary to the Bank.

Keep following www.gheducate.com for credible news and updates.